S Corp vs. C Corp

Last Updated: By TRUiC Team

Trying to decide between a C corporation (C corp) and an S corporation (S corp)? The differences between them can seem pretty confusing so we’re here to help.

If you’re just starting a business, debating about which legal structure to choose for your company, or interested in designating your business as a C corp or an S corp, read on. We’ll walk you through the ins and outs of C corps and S corps so you can decide on the best legal and tax structures for your business.

Ready to form your business now? We recommend using a business formation service to save yourself some hassle and get your S corp or C corp up and running quickly.

Skip Ahead:

Legal Structure vs. Tax Designation

What Is a C Corporation?

What Is an S Corporation?

C Corp Taxes vs. S Corp Taxes

Which Is Best, a C Corp or S Corp?

When Is It Best to Elect C Corp Status?

When Is It Best to Elect S Corp Status?

Frequently Asked Questions

Legal Structure vs. Tax Designation

It can be difficult to compare C corps to S corps because a corporation is a legal business entity that separates the company from its owners while an S corp is a tax designation a legal business entity may elect. This article will compare the default C corp tax structure to the S corp tax designation.

- Legal Structure: This is the legal framework under which you organize your business. A limited liability company (LLC) is one of four primary types of legal structure, which include:

- Tax Designation: This dictates how a business pays its taxes. A company’s tax designation is closely related to — but separate from — its choice of legal structure. S corp status is a business tax designation that both LLCs and C corporations may elect.

By default, the Internal Revenue Service (IRS) taxes C corps as corporations. However, a C corp can choose to be taxed as an S corp if it meets S corp requirements.

What Is a C Corporation?

C corporations are more formal, less flexible legal entities owned by shareholders and managed by a board of directors. They must adhere to more complex rules and procedures than LLCs or informal business structures.

Corporation Taxation Overview

A C corp is the default tax designation for corporations, although corporations that meet the qualifications and restrictions may elect to be taxed as S corps. The C corp tax designation is a tax status where the corporation is responsible for paying tax on the company’s profits. When a company distributes dividends or capital gains distributions, its shareholders are also responsible for paying tax on their individual distributions. This is why the C corp tax structure often earns criticism for double taxation because the corporation’s profits get taxed at both the company and individual level.

Investors and Growth

Corporations are the best business structure for bringing on investors. With a corporation you can issue multiple classes of stocks, and shareholders only pay income tax on personal dividend earnings. If you plan on seeking external funding, most investors will expect your business to be a C corporation.

Planning on incorporating? Hire a formation service to help simplify the incorporation process for you.

What Is an S Corporation?

An S corp is a tax designation that an LLC or a corporation may elect. With S corp tax status, a business entity’s profits and losses pass through to its shareholders. Because of this, LLCs and corporations that elect S corp status are exempt from paying corporate income tax.

The owners of an S corp instead have their business’s income taxed at the individual level — split between a reasonable salary and the remainder of the profits as distributions from the company.

S Corp Tax Advantages

S corp status can provide significant tax advantages when a business makes enough to pay its owners large sums in distributions. In general, we estimate your business will need to make $60,000 in net earnings with $20,000 in annual distributions to benefit from the tax advantages offered by S corp status.

Use our S corp tax calculator to determine if S corp status will benefit your business.

Qualifying as an S Corp

LLCs and corporations must meet several requirements in order to qualify to elect and maintain their S corp tax designation.

S Corp Shareholders

S corps must have no more than 100 shareholders and may only issue one class of stock. In addition, all S corp shareholders must be US citizens or resident aliens, or certain types of domestic estates, trusts, and tax-exempt organizations.

As a result, non-US citizens and nonresident aliens — or any other non-U.S. entity — may not own an S corp in whole or in part. US corporations and partnerships also aren’t permitted to own shares in an S corp.

Reasonable Salary

S corporation rules require that any S corp owner who simultaneously acts as a director, a manager, or who performs any work within the organization pay themselves a reasonable wage (with the appropriate taxes withheld) through the firm. The IRS, therefore, considers S corp owners employees who must pay themselves a reasonable salary.

Additional Restrictions

Various types of US institutions are barred from owning an S corp, such as financial institutions, insurance companies, and domestic and international sales corporations.

Additionally, companies that accumulate earnings and profits at the end of three straight years and earn more than 25% of their income from passive sources don’t qualify for (or qualify to maintain) S corp status.

If you’re ready to form your S corp, avoid the hassle and consider using an S corp formation service to get your business set up quickly.

C Corp Taxes vs. S Corp Taxes

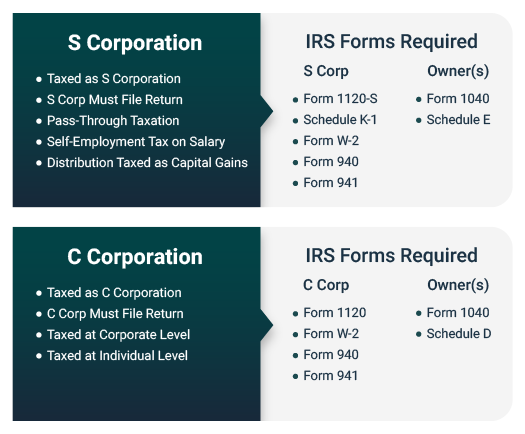

The IRS considers C corps and S corps as distinct tax designations with different rules, reporting requirements, and levels of taxation. Specifically:

- C corporations are business entities taxed at the corporation level.

- S corporations are a hybrid form of pass-through entity in which the business’s profits and losses pass through to their shareholders and aren’t taxed at the company level.

C Corp Taxes

C corporations fall under a tax structure where the company is responsible for reporting and paying tax on its profits. Therefore, C corps pay tax on their profits at the company level. A corporation may then retain its after-tax profits or distribute them to shareholders in the form of dividends or distributions. Shareholders must then report and pay tax on the distributions they receive.

Double Taxation

Because company profits are taxed at both the corporate and individual level, C corporations are known as “double taxation” entities. However, a corporation’s profits aren’t taxed at the individual level until the company distributes them. Thus, a corporation may retain or reinvest its after-tax profits in the company, allowing shareholder equity to grow untaxed until it’s realized.

How to File C Corp Taxes

C corporations must complete a number of tax returns and related forms to meet their tax obligations.

Corporate Income Tax Return

C corps must file Form 1120: US Corporation Income Tax Return along with all necessary forms and schedules to report their income, deductions, credits, profits, and losses.

Documents Related to Having Employees

Because the IRS requires corporation owners to receive reasonable compensation, a C corp will have employees and must submit the required employment tax filings. These include the annual federal unemployment tax (FUTA) and quarterly filings to the IRS on behalf of its owners and employees. The required forms include Form W-2, Form 940: Employer’s Annual Federal Unemployment Tax (FUTA) Return, and Form 941: Employer’s Quarterly Federal Tax Return in addition to any filing requirements imposed by their state.

C Corp Shareholder Taxes

C corp owners are responsible for reporting any wages or salary they receive from the company — along with any taxes withheld (as reported on their Form W-2) — on their personal tax return (Form 1040). They also must report and pay tax on any dividends, distributions, or capital gains they realize from their ownership stake in the corporation.

S Corp Taxes

The IRS treats S corps as hybrid pass-through tax entities. This means the company’s earnings pass through to its owners (or shareholders) and its profits aren’t taxed at the company level.

S corporations differ from other pass-through entities, however, in that their business profits and losses pass through to their owners in two ways. First, S corp owners must pay themselves a reasonable salary for the work they perform within the company. Second, the remaining profits are then treated as distributions from the firm.

Reasonable Salary

S corp shareholders who serve as a director, a manager, or who perform any work within the organization must receive a reasonable salary. According to the IRS, reasonable compensation equates to “the value that would ordinarily be paid for like services by like enterprises under like circumstances.”

S corps are responsible for calculating, reporting, withholding, and paying employment and withholding taxes on all employee salaries and wages. They’re also responsible for calculating, reporting, and paying federal unemployment insurance as well as any other taxes or insurance required by their state.

Distributions

The remainder of an S corp’s profits pass through to its shareholders in the form of dividends or distributions. Each individual shareholder is then responsible for paying personal income tax on their individual salaries and share of the profits.

How to File S Corp Taxes

S corps must take several steps to fulfill their tax-filing obligations, including:

- Filing Form 1120S: US Income Tax Return for an S Corporation along with all corresponding forms and schedules with the IRS. This form reports on an S corp’s income, deductions, shareholders, profits, and losses.

- Filing Schedule K-1 (Form 1120S) for each shareholder to report how the company allocated its profits and losses.

Because S corp owners must receive a reasonable salary for any work they do within the company, S corps will technically have employees. That means they’ll need to file and pay annual federal unemployment tax (FUTA) as well as an employer’s quarterly tax returns with the IRS. Specifically, S corps must:

- Report all employee salaries and wages paid during the year to the IRS, using the corresponding copies of Form W-2.

- File Form 940, Employer’s Annual Federal Unemployment Tax (FUTA) Return.

- File Form 941, Employer’s Quarterly Federal Tax Return to report and pay the income taxes, Social Security taxes, and Medicare taxes the company withheld from employees’ paychecks. S corps also use this form to pay their employer’s share of Social Security and Medicare taxes.

S Corp Shareholder Taxes

S corp owners must then report their wages or salaries — along with any taxes withheld (as reported on their Form W-2) — on their personal tax return (Form 1040). They also need to report any dividends or capital gains distributions as indicated on their Schedule K-1 on Schedule E.

Which Is Best, a C Corp or S Corp?

The best tax designation for your company highly depends on the nature of your business and your specific situation. Whether it’s better to elect to be taxed as a C corp or an S corp can vary based on the size of your company, its organizational structure, your need for investment and financing, your goals for growth, and many other factors.

Let’s review the advantages and disadvantages of C corps and S corps as well as when it may be best to choose one vs. the other as your tax designation.

Many businesses turn to formation services to form their C corporation and apply for S corp status.

When Is It Best to Elect C Corp Status?

C corporations are the most common type of corporation in the United States, representing millions of businesses. Before you can decide if choosing a C corp tax designation is right for your business, consider its key advantages and disadvantages.

C Corp Advantages

A C corporation can offer a number of advantages for many companies, including:

- Perpetual existence

- An unlimited number (and types) of stockholder

- The ability to issue multiple classes of stock

- Funds, trusts, and organizations can be investors

- The ability to retain earnings in the corporation

- It’s easy to sell or transfer equity

- Equity sales are subject to favorable capital gains tax rates

C Corp Disadvantages

Unfortunately, despite all of their benefits, corporations are more complex than many other business structures. That means C corps also have a number of disadvantages, including:

- Greater complexity that requires more paperwork

- Stricter regulations and formalities

- Profits may be subject to double taxation

- Corporate losses don’t pass through to owners

When Is it Best to Choose C Corp Taxation?

There are many situations in which choosing to be taxed as a C corporation is the right decision. Although a corporation is more difficult to form and maintain than other business structures, it’s the smart — and sometimes only — choice for many companies.

Reinvesting Profits

As a C corporation, a company can retain and reinvest its profits within the organization. Unlike pass-through tax entities, a C corp’s owners (or shareholders) don’t pay tax on the business’s profits until they’re distributed. Thus, a C corp often is the best choice if you plan to build and grow a large company.

Obtaining Investors

C corporations also have a very investor-friendly design. It’s easy to buy, sell, or transfer equity in a C corp — and there are no restrictions on who can be a shareholder. In addition, C corporations allow investors to defer taxes on the growth of their equity until it’s realized. That makes C corps the preferred business entity of investors. Therefore, a C corp is often the best option if you plan to raise institutional or venture capital or to take your company public.

When Is It Best to Elect S Corp Status?

S corps status can prove very beneficial for some businesses, but you should consider both its advantages and disadvantages before electing this tax designation.

S Corp Advantages

S corporations combine the advantages of a corporation or an LLC with a hybrid pass-through tax treatment, which can appeal to many different types of businesses. Here are the key advantages of S corp status:

- No company-level tax on profits

- Losses pass through to shareholders

- Employment taxes apply only to salaries, not distributions

- Excess profits paid as distributions are taxed as capital gains distributions

S Corp Disadvantages

While electing S corp status can prove beneficial in many cases, this tax designation also comes with several disadvantages. These include:

- Complex tax reporting

- Shareholder equity determines distribution of profits and losses

- Increased accounting and tax reporting requirements

- May only issue one class of shares

- Limited to 100 shareholders

- Shareholders must be US citizens or resident aliens (and some estates, trusts, and tax-exempt organizations)

- Some states tax S corps as corporations

When Is It Best to Choose S Corp Taxation?

Electing S corp status may be the best option for corporations seeking to avoid double taxation. However, you need to consider a number of factors like the fact that S corps come with restrictions on the number and type of shares they can issue as well as on who can be a shareholder.

If you don’t anticipate needing outside investors, it’s best to determine if — and when — your business profits will allow the tax savings to justify the added costs involved in forming and maintaining an S corp.

As a general rule, the S corporation tax designation usually proves beneficial when your company’s annual profits reach a minimum threshold of $60,000 to $100,000. However, this’ll depend on your unique situation.

Still unsure if you should elect S corp status? Consult with an accountant and/or tax professional about how this tax designation will impact you and your business.

Frequently Asked Questions

Should I form an LLC or a corporation?

The decision to incorporate a corporation or an LLC will depend on the specific circumstances of your firm. Your organization’s size, structure, and goals, among other factors, will determine if you should incorporate a corporation or an LLC.

Read our guide on how to choose a business structure to learn more about which legal business structure is best for your company.

Do corporation owners pay self-employment tax?

No. The owners of corporations don’t pay self-employment taxes. Both C corps and S corps must treat their owners as employees of the business and pay them a reasonable salary if they perform any work for the company. Thus, if you own a company that elects the C corp or S corp tax designation, your salary is subject to employment taxes (i.e., Social Security and Medicare taxes) — half of which is withheld from your salary as an employee and half of which is paid by the corporation.

Can you switch from an LLC to an S corp?

Yes. LLCs can elect S corp status by completing and filing Form 2553 with the IRS.

Can you switch from a C corp to an S corp?

Yes. Corporations also can elect S corp status by completing and filing Form 2553 with the IRS