Debbie Profile

Last Updated: By TRUiC Team

Paying off debt has never been more enjoyable with Debbie, the fintech startup with a rewards platform geared towards debt payoff.

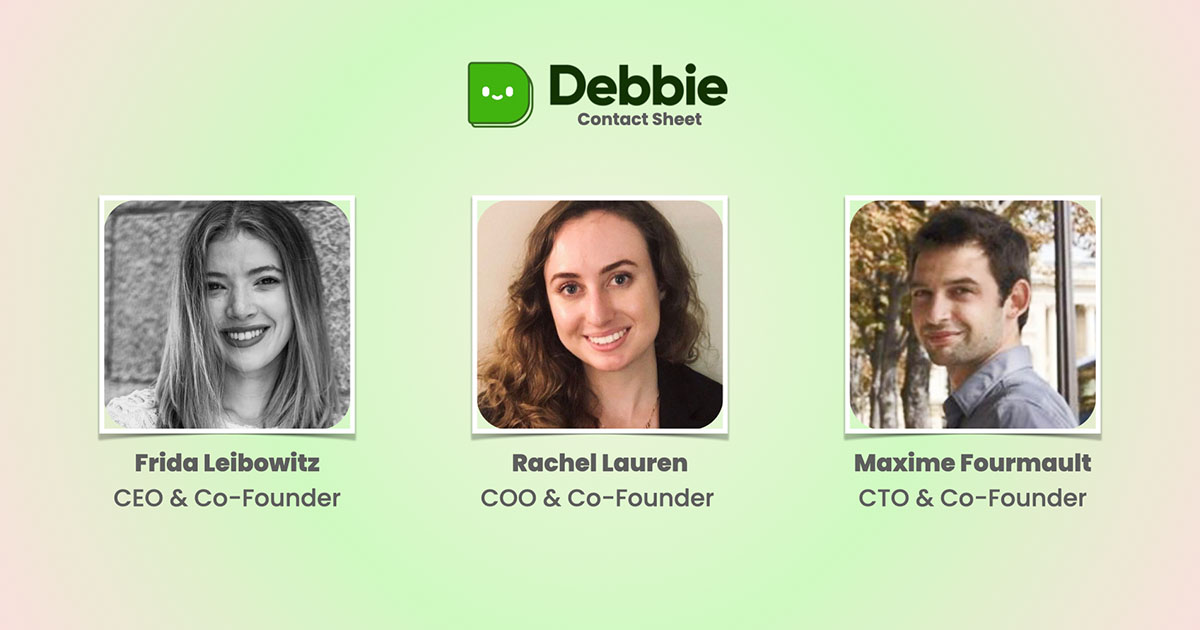

Interview Frida Leibowitz, Rachel Lauren, and Maxime Fourmault

Describe your product or service:

“Debbie is the first rewards platform for debt payoff.”

Describe your company values and mission:

“Our mission is to help borrowers transition to wealth-builders by taking a Noom approach to debt payoff.”

How are you funded? I.e. type of funding, number of funding rounds, total funding amount.

“We raised a $1.2 million pre-seed round from some awesome mission-aligned investors like One Way VC, Village Global, Liquid 2 Ventures, BDMI, Green Egg Ventures, TA Ventures, and If Then Ventures.”

How big is your team? Tell us a little about them (I.e. co-founders, freelancers, etc.)

“We are a team of nine (three co-founders (CEO, COO, and CTO), one head of marketing, three engineers, one product designer, and an operations/marketing intern).”

How did you come up with and validate your startup idea? Tell us the story!

“We started by becoming deeply ingrained within the debt freedom community. We ran polls and 1:1 interviews with folks within these communities on Facebook and Instagram and began to understand that the financial products/technology solutions targeting this industry were not built to solve this problem. Financial institutions have attempted to push additional debt onto people without providing any guidance, while technology solutions have tried to automate the problem away.”

How did you come up with your startup's name? Did you have other names you considered?

“We felt that Debbie was the perfect name for a challenger brand in an industry with male-named fintechs (Marcus, Albert, Dave, and Finn), in addition to subverting the word ‘debt.’ As a cherry on top, Frida's sister's and Rachel's mother's names are Debbie.”

Did you always want to start your own business? What made you want to become an entrepreneur?

“Frida and Maxime have always been entrepreneurial and unafraid of risk but have been looking for a problem they felt passionate enough to solve. Rachel, on the other hand, is more risk-averse and provides the foil within the relationship. We were driven to create Debbie because the problem became so obvious while the solutions felt incredibly subpar. Having worked directly in the industry prior (in consumer lending and venture capital), we felt we had the experience to execute upon the solution.”

Did you encounter any roadblocks when launching your startup? If so, what were they and what did you do to solve them?

“Our biggest roadblock was just about getting started — an idea can be a ‘part-time project’ forever. Psychologically preparing oneself to go all-in is one of the biggest challenges but was also the biggest unlock for the business.”

Who is your target market? How did you establish the right market for your startup?

“Our target market is the 40% of American families who find themselves in revolving credit card debt. Most people either don't realize that paying the minimum payments will keep them in a perpetual state of debt, or their spending habits continue to stay the same despite racking up a credit card bill. The market for balance transfers and personal loans has increased dramatically as a result of high credit card debt levels, driven by folks who want to better their situation. It's time to provide them with the tools to create long-lasting change.”

What's your marketing strategy?

“As mentioned previously, we are deeply ingrained in the debt freedom communities on Instagram and Facebook. We started there by creating content and partnering with key influencers in the space and will continue to work hard to build a brand there.”

How did you acquire your first 100 customers?

“We found a really great hook — ‘get paid to pay off your debt.’ People were attracted by the catchy line and became interested in Debbie as they read more about the brand.”

What are the key customer metrics / unit economics / KPIs you pay attention to to monitor the health of your business?

“We look at waitlist growth, conversion from the waitlist, cost per lead, and cost of acquisition. Today, our waitlist stands at 10,500+ (from 300 around five months ago), our conversion is around 30% of the folks we offboard, our cost per lead is ~$1.50, and our cost of acquisition to the app is approximately $5. We feel those are stats to be proud of.”

What's your favorite startup book and podcast?

“‘Who’ by Geoff Smart — this is a great starter on how to hire. With respect to podcasts, ‘How I Built This’ is an old favorite.”

What is a song or artist that you listen to for motivation?

“Rachel: Kanye.

Frida: Lindsey Stirling.

Maxime: Beat It by Michael Jackson.”

Is there a tool, app, or resource that you swear by to help run your startup?

“Notion and Slack — these are our primary sources of truth in terms of communication and project management.”

What is something that surprised you about entrepreneurship?

“Hiring and engaging employees is the most rewarding part of building a business. When it's just you, it's difficult to see the progress. As the company grows, you not only provide jobs to people, but you make great friends working towards a shared goal.”

How do you achieve work/life balance as a founder?

“This is definitely a difficult one — sanity walks are important. To be honest, in the beginning, it's nearly impossible to have a good work/life balance. Starting the company in Miami has been really helpful in this respect because there are lots of opportunities to get outside, be active, and relax.”

What is a strategy you use to stay productive and focused?

“Frida and Maxime would say coffee, first and foremost. For Rachel, it's having co-founders who keep you accountable.”

Did you have to develop any habits that helped lead you to success? If so, what are they?

“Being accountable for your actions (whether successes or failures) is important as it creates an environment for reflection, which ultimately leads to growth. At the company, we are all accountable for our respective tasks, though we lean on each other for help.”

What was your first job and what did it teach you?

“Frida: My first job was at Marcus by Goldman Sachs. It was one of the best places to start my career, and I learned an incredible amount with respect to consumer lending and financial products. However, I also learned that years of experience in an industry can lead to less innovative thinking.

Rachel: My first job was as an equity research analyst at Credit Suisse. I learned how to build models, speak to clients, and be rigorous about researching trends and industries. However, I also learned that markets are 110% about perception and staging rather than intrinsic company value. This is why I seek growth over value when investing as I am a long-term holder and almost never time markets properly.

Maxime: My first job was as an engineer at a cybersecurity company, where I learned all of the ways people trick companies and individuals out of their money. This is incredibly useful in the financial sphere and something I carry to this day.”

Recommended:

- Keep up with more startup companies by visiting our list of the top startups to watch.

- Hear startup stories from real founders on the Startup Savants podcast.

- Form your own startup by reading our review of the best online incorporation services.

Tell Us Your Startup Story

Are you a startup founder and want to share your entrepreneurial journey withh our readers? Click below to contact us today!

More on Debbie

The Startup Changing the Way We See Debt

Fintech startup Debbie was founded with the vision of helping borrowers transition from debt holders to wealth builders as quickly and efficiently as possible.

Founder of Fintech Startup Debbie Shares Their Top Insights

Rachel Lauren, founder of fintech startup debbie, shared valuable insights during our interview that will inspire and motivate aspiring entrepreneurs.

Here’s How You Can Support Fintech Startup Debbie

We asked Rachel Lauren, founder of Debbie, to share the most impactful ways to support their startup, and this is what they had to say.