How to Distribute Startup Equity

Last Updated: By TRUiC Team

Your startup is taking off, and it is time to incorporate your company. Now comes the big question. How will you divvy up and distribute the equity in your startup?

In this guide, we will walk you through how startup equity works and the factors you need to consider when allocating startup equity.

Here is what’s ahead:

What Is Equity?

How Does Equity Work in a Startup?

Allocating Startup Equity: Factors to Consider

Startup Equity: Key Terms

Frequently Asked Questions

What Is Equity?

In finance, equity refers to the value of ownership, or distribution of ownership, of an asset. Often ownership or equity is in an asset that has debt or liabilities tied to it — like a business. Here, the book value of an owner’s equity is equivalent to the company’s assets minus its liabilities.

When referring to startup equity, the two most common types of equity are common stock and preferred stock. Common stock is the class of stock most often issued to founders and employees and comes with voting rights in the organization.

The second type of startup equity is preferred stock. Preferred stock grants some rights to its shareholders, including priority in receiving dividends and liquidation preferences; however, preferred stockholders do not receive voting rights in the company.

How Does Equity Work in a Startup?

There are several major steps to distributing startup equity:

Allocating Equity

The first task in distributing equity in a startup is allocating your startup equity. There are a number of factors to consider when allocating startup equity, including who gets startup equity and how much startup equity each person receives. You will need to decide what percentage of the company each co-founder will own and how much will be allocated to investors, advisors, early employees, and key talent.

Determining the Size of Your Option Pool

When allocating shares to co-founders and others in your startup, you will also need to determine the size of your option pool. An option pool is a portion of shares set aside to compensate and incentivize early employees. This is an attractive way for cash-strapped startups to attract key employees and top talent.

Although the size of your option pool will depend on how much hiring you intend to do, in most startups, option pools normally range from 10% to 20%.

The Vesting Schedule

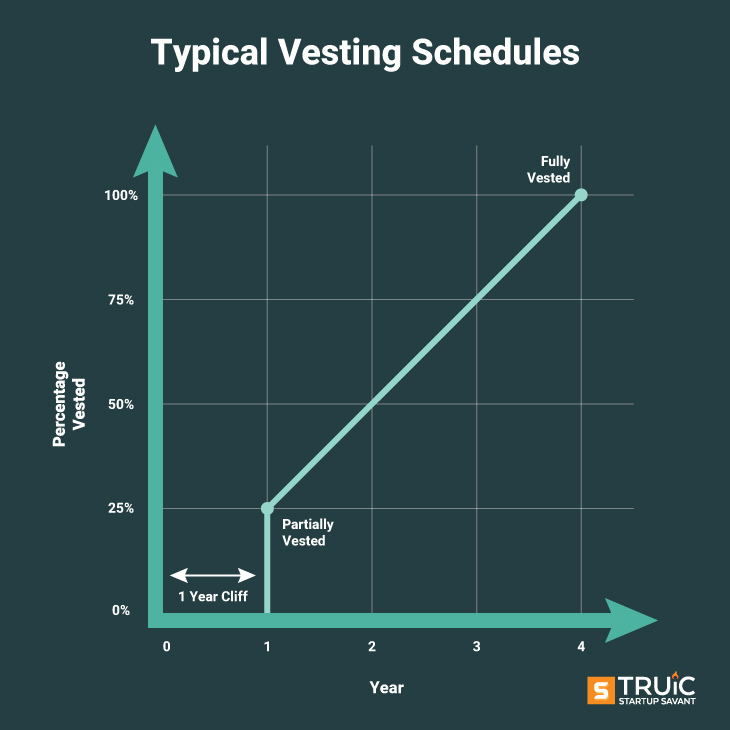

You will also need to determine how shares will vest in your startup. Vesting is the process of a co-founder or employee securing, or earning, their promised stock incentives, options, or employer contributions over time.

Vesting ensures that co-founders (as well as key employees, etc.) stay with the firm long enough to justify the equity they will receive in the company.

In many startups, co-founders’ and employees’ stock and stock options typically vest over a number of years (often fully vesting at approximately four years). If the co-founder or employee were to leave the firm, they may only be entitled to a portion of the equity in the startup that they were allocated. For example, if a co-founder was allocated 20% equity and left the company after two years, only half of his or her equity would be vested. The remainder of the equity allocated to that co-founder would then be retained by the company.

Many vesting agreements also incorporate a one-year cliff. A one-year cliff is a clause in a vesting agreement that states that a co-founder (or an advisor, board member, employee, etc.) must stay with the company at least one year before their equity begins to vest. In this case, if the co-founder (or employee, etc.) were to leave the startup before one year, they would not be eligible for any of the equity that was allocated to them.

Authorizing Shares

Once you have determined your allocation of shares, you will also need to determine how many shares to authorize and how many to issue. Authorized shares are the maximum number of shares that you are permitted to issue. This will be recorded in your articles of incorporation.

Authorized shares are not the same as outstanding shares. Outstanding shares are the total number of shares that are issued, including those allocated to founders as well as unvested shares. Outstanding shares do not include unallocated shares in an option pool.

Option pool shares are not issued before the corporation awards options, these options are approved by the board of directors, and they are vested and exercised by the option grantee.

For instance, the most common number of shares to authorize is 10 million shares. This is the total number of shares that the company can issue. However, among these 10 million shares, you may only plan on initially issuing about half of them between your founding team, key employees, and your option pool. If you are planning on setting aside 10% for an unallocated option pool, 4.5 million outstanding shares is the number that would be issued.

Creating a Cap Table

With all of the above decisions complete, you will need to record them. This is done in a cap table. A cap table is a spreadsheet that keeps track of the company's ownership percentages, stock dilution, and equity value in each round of investment.

A cap table keeps track of your authorized shares and outstanding shares as well as each of your classes of securities such as common and preferred shares, options, and warrants.

You can create a cap table from scratch, from a template, from specialized software, or with your accountant or financial guru.

Purchasing Founder Shares

Finally, the co-founders of your startup will have to document and purchase their shares.

The purchase of a founder’s shares needs to be documented in a Founder’s Stock Purchase Agreement that defines the founders’ ownership in the company and sets the terms of the founders’ initial purchase of stock from the company. A Founder’s Stock Purchase Agreement typically includes any vesting, transfer, or sale provisions agreed to by the founders.

Finally, founders must purchase their initial shares.

Yes, founders actually pay for their shares. This is part of the reason that it is better to incorporate your startup sooner rather than later. When you incorporate your startup early, the value of each share is usually insignificant, especially when you plan on issuing millions of shares. However, founders still pay. If you wait until after your company has taken on investment the value of these shares will increase dramatically and cause hurdles to your incorporation.

Recommended: Most startups work with an attorney to write their founders’ agreements and incorporation documents. Read our guide on how to find a lawyer for your startup.

Allocating Startup Equity: Factors to Consider

Why Allocate Startup Equity?

Before you begin allocating startup equity, consider why you are allocating startup equity. Equity is one of the most valuable assets of your startup. You need to think carefully before granting others ownership in your startup.

That being said, equity is one of the most valuable assets your startup has. Furthermore, launching and growing your startup often requires that you use your startup’s equity as a resource.

Equity is used to incentivize and reward everyone that it takes to launch and grow a startup. It is often used as compensation for co-founders who put in massive amounts of time and effort (often without pay). It is used to attract advisors and mentors to offer their time and expertise and often serve as directors of the organization. It is used to entice and compensate top talent to take the risk of joining a startup organization.

Equity also incentivizes startup teams, giving them skin in the game, boosting dedication and loyalty, increasing the chances they will stay with the company, and giving them the opportunity to reap the rewards of the startup’s future success.

Who Gets Startup Equity?

The first thing you need to consider when determining how to allocate startup equity is “Who gets startup equity?” You will need to decide what percentage of the company each co-founder will receive.

Co-founders aren’t the only stakeholders to who you may want to offer equity. You will also need to determine how much equity to allocate to advisors, early employees, and key talent. Additionally, determine how much equity you wish to allocate or reserve for investors.

Distributing Equity Among Founders

The primary question in allocating equity to founders is, “What will each founder contribute to the long-term success of the startup?” The allocation of equity to co-founders should reflect the full value of the contributions they are anticipated to provide.

Founders and co-founders should be first in prioritizing your startup’s equity. In general, most startups allocate 60% or more of equity to their founders and co-founders.

The weighing of co-founders' contributions might include past contributions such as seed money, ideas, or intellectual property. However, remember your startup is still growing, and you should anticipate many challenges to come. For this reason, expected future contributions such as knowledge, expertise, and time should be the biggest determinant of equity allocations.

For example, if each co-founders’ contributions are expected to be equal, the starting equity should be distributed fairly evenly among them (i.e., 19%, 19%, and 22%). However, if you expect the co-founders' contributions will be uneven, it might be justified to grant a larger share of the initial startup equity to the founder(s) who will add the most value to the business.

Distributing Equity Among Investors

As a startup founder, you will also likely need to allocate equity for investors. The first investors in your startup are likely to be friends and family or angel investors. In the pre-seed and seed funding rounds, startups raise anywhere from $50,000 to $200,000 for a 5% to 10% equity stake.

As your business grows, you may also decide to raise additional capital. Institutional investors like angel investors or venture capitalists commonly ask for 20% to 30% of the equity in your company during seed and Series A funding rounds, so you should also account for this as you are planning how to allocate equity.

Distributing Equity Among Advisors

Another group of influential stakeholders in your startup are your startup’s mentors and advisors. Advisors not only provide guidance and advice but also access to their connections and their networks.

Startups commonly allocate up to 5% of equity to compensate mentors and advisors for their help launching and growing their organizations.

Distributing Equity Among Employees

It has become increasingly common for startups to also offer equity (most often in the form of stock options) to their early and key employees as a way to attract key talent while controlling salary expenses. In lieu of expert-level pay, startups use the promise of equity to attract, reward, and retain key employees.

In fact, startups often allocate 10% or more of startup equity for attracting and retaining early and key talent. Incentivizing employees with ownership in the company motivates employees to invest in their work, think about the company’s success, and achieve compensation for the long-term value they create.

With everyone getting a piece of the pie, you may be wondering what a typical equity allocation looks like. Here is an example of how equity may be distributed among a startup with three founders using the common equity allocations from above:

With everyone getting a piece of the pie, you may be wondering what a typical equity allocation looks like. Here is an example of how equity may be distributed among a startup with three founders using the common equity allocations from above:

Also recommended: Read our guide on what to do after incorporating your startup.

Startup Equity: Key Terms

Common Stock

The most common type of stock and the class of stock most often issued by founders and employees is common stock. Common stock represents ownership in the company, and all common stockholders are granted voting rights and are permitted to vote on the board of directors and corporate policy.

Dilution

Equity dilution, or stock dilution, is the reduction in existing shareholders’ percentage of ownership of the company that results from the company raising further funding (i.e., issuing additional shares of stocks).

Dividends

Dividends are distributions from the company’s earnings to its stockholders. Dividend distributions are determined by the board of directors and may be appropriated differently among classes of shareholders.

Liquidation Preference

Most term sheets will contain a liquidation preference which, as its name suggests, dictates how various investors receive dividends or payouts in the case of liquidation. Typically, investors and preferred stockholders receive their payouts first, and common stockholders and other asset holders receive their distributions from what is left.

Liquidity Event

A liquidity event is an event such as an acquisition, merger, initial public offering (IPO), or other move that allows a company's founders and other early investors to convert their shares of the company into cash. It allows them to cash in and cash out.

One-Year Cliff

A one-year cliff refers to a clause in many equity agreements that states that a co-founder (or an advisor, board member, employee, etc.) must stay with the company at least one year before their equity begins to vest.

Stock Options

A stock option is a contract that grants the option holder the right to purchase shares of a company’s stock at a predetermined price and time in the future. Stock options do not represent actual shares of stock — nor do they obligate the option holder to purchase shares of stock. Rather, stock options simply give the holder the right to purchase shares in the future at the pre-set price.

Nonqualified Stock Options

Nonqualified stock options are stock options that are granted to employees where the benefit to the employee or the “spread” between the predetermined option price and its current value is taxed as income when the stock is exercised.

Option Pool

A portion of shares set aside to compensate and incentivize the employees of a private company. An option pool is a way to attract top talent to early-stage startups.

Preferred Stock

Preferred stock is a class of stock that grants some rights to its shareholders, including priority in receiving dividends and liquidation preferences; however, preferred stockholders do not receive voting rights in the company.

Qualified Stock Options

Qualified stock options, or incentive stock options, are options granted to employees of a company that are taxed at a favorable rate under certain conditions. Unlike non-qualified stock options (which are taxed as income), qualified stock options are taxed at the (significantly lower) capital gains tax rate as long as they are held for two years from the date granted and one year from the exercise date.

Shares

A share, or share of stock, is a security representing ownership of a fraction, or “share,” of a corporation. Simply put, shares are units of equity ownership. Together, all of the shares make up the total “stock” of the organization.

Strike Price

The strike price is the predetermined price that is granted in a stock option contract. It is the price that the option holder must pay to exercise (purchase) stock. The difference between the strike price and the market value of an option, also known as the spread, is the option holder's potential gain.

Valuation

Valuation is the process of estimating the monetary value of a business. There are several primary types of valuations including asset-based, revenue-based, and market-based valuations. The best valuation method depends on the characteristics of the company and the purpose of the valuation.

Vesting

Vesting is the process of securing, or earning, a co-founder or employee’s promised stock incentives, options, or employer contributions over time. For example, a startup co-founder’s stock and stock options typically vest over four years, either a portion monthly from the beginning or a portion monthly following a one-year cliff.

Warrants

Warrants are another type of startup equity that provides the warrant holder the right to buy or sell shares of a company’s stock at a predetermined price within a stated time frame. Warrants are similar to stock options, except that where stock options are drawn from an option pool, warrants require the company to issue new stock, diluting the ownership of all shareholders.

Startup Equity FAQ

What is equity?

In finance, equity refers to the value of ownership of an asset. In a business, the book value of an owner’s equity is equivalent to the company’s assets minus its liabilities.

What are the common types of equity?

In accounting and financial terms, there are several types of equity. In terms of startup equity, the two most common types of equity are common stock and preferred stock. Other types of equity include warrants, additional paid-in capital, and retained earnings.

Who gets equity in a startup?

Startups typically award equity to key stakeholders involved in launching and growing the company. While startup founders begin owning 100% of the equity, startups often reserve equity for investors as well as use equity to incentivize advisors, early employees, and key talent.

How is equity divided in a startup?

When dividing equity, founders often allocate:

- 60% for founders and co-founders

- 20% to 30% for investors

- 5% for advisors

- 10% to 20% for early and key employees

How do startups manage equity?

Founders allocate equity, create a vesting schedule, authorize a predetermined maximum number of shares, and document and purchase founders’ shares at the time of incorporation. The startup must then track and document all details of shares authorized, shares outstanding, the transfer of shares, and the ownership of all shares in a spreadsheet known as a cap table.