Private Equity vs. Venture Capital

Last Updated: By Reyna Hurand

Whether you're an entrepreneur poised to launch a startup or an investor looking to dive into the world of private funding, you've likely come across terms like private equity (PE) and venture capital (VC). Throughout this article, we’ll provide a clear understanding of what these terms mean, their core differences, and how to decide which may be the right fit for your unique entrepreneurial or investment goals.

VC vs. PE: What’s the Difference?

Venture capital and private equity are two prominent investment vehicles that play crucial roles in financing businesses at different stages of growth.

We’ll explore the distinctions between these two investment approaches, examining their key characteristics, investment strategies, and the types of companies they typically support.

Understanding Private Equity

Private equity involves investing in companies that are not listed on a public exchange. PE firms buy a majority stake in mature companies, then work to improve their financial health and sell them off at a profit.

PE emerged during the 1970s and 1980s when firms started buying undervalued companies to turn them around. It's been a key part of the financial world ever since.

The main advantage of PE is the availability of substantial capital and financial expertise. However, it often involves increased scrutiny and potential loss of control as these investors seek to maximize returns.

Understanding Venture Capital

On the other hand, venture capital is a type of private equity that funds startups and small businesses with high growth potential. VCs emerged around the same time as PEs and have played a pivotal role in the tech boom of the 1990s and 2000s.

The beauty of VC lies in the fact that they provide not only funding but also mentorship and access to a vast network. However, they also come with high expectations and can lead to a dilution of ownership.

Private Equity vs. Venture Capital: The Key Differences

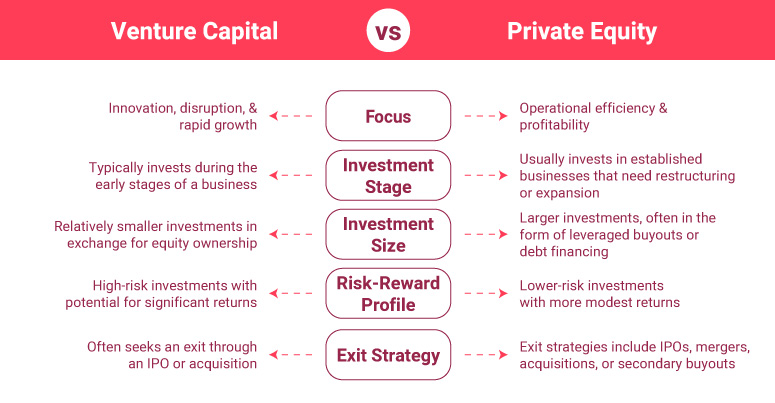

While both PE and VC provide funding, they differ in a few key areas:

Investment Focus

VCs typically focus on early-stage and high-growth companies with significant growth potential. They invest in startups and early-stage businesses that have innovative ideas or disruptive technologies.

PE typically focuses on later-stage companies that are more established and have a proven track record of generating revenue and profits. PE firms often invest in mature companies to facilitate growth, restructure operations, or pursue acquisitions.

Investment Size

VC investments are typically smaller in size, ranging from a few hundred thousand dollars to tens of millions of dollars.

PE investments are significantly larger, ranging from tens of millions to billions of dollars.

Risk Appetite

Venture capitalists generally have a higher risk appetite and are willing to invest in startups and early-stage companies that have a higher risk of failure. They understand that a significant portion of their investments may not succeed, but they aim for the few successful investments to generate substantial returns.

Private equity investors tend to have a lower risk appetite compared to venture capitalists. They look for established companies with a proven track record and stable cash flows. PE investors aim to generate returns through operational improvements, cost-cutting measures, and eventual divestment or sale of the company.

Level of Involvement

Venture capitalists often provide guidance and support to early-stage companies beyond just capital. They actively engage with the company's management, offering strategic advice, mentoring, and access to their network of contacts. However, their level of operational involvement is typically lower than that of private equity investors.

Private equity firms take a hands-on approach and actively participate in the operations and management of the companies they invest in. They bring in operational expertise, implement changes to improve efficiency, optimize the capital structure, and drive growth initiatives. PE investors often have dedicated teams with industry expertise to help their portfolio companies achieve their financial and operational goals.

Return on Investment Expectations

Venture capitalists often aim for a return of 10x to 30x their original investment over a period of about 5–10 years, depending on the specifics of the deal and the company.

Typical return expectations for private equity investments might be around 2x to 5x the original investment over a period of about five to seven years, again depending on the specifics of the deal and the company.

PE vs. VC: Case Studies

It's always helpful to look at real-life examples to understand concepts better. Airbnb is a remarkable example in the venture capital world. Founded in 2008, Airbnb received its first significant VC funding from Sequoia Capital in 2009. The investment enabled Airbnb to innovate and expand globally, disrupting the hotel industry. When Airbnb went public in 2020, it was valued at over $100 billion, demonstrating the high-risk, high-reward nature of VC investments.

Another example is Slack. VC firms such as Andreessen Horowitz and Accel saw great potential in Slack's innovative approach to team communication and collaboration. Their investment enabled Slack to rapidly scale its operations and user base. By the time Slack went public in 2019, it was valued at over $20 billion, showcasing the impact of venture capital in supporting high-growth potential startups.

In the world of private equity, an illustrative example is Hilton Hotels. Blackstone, a major private equity firm, acquired Hilton Hotels in 2007. They didn't drastically change the business; instead, they improved its operations and expanded the business globally. When Blackstone took Hilton public again in 2013, it was far more valuable. This underscores the PE approach of enhancing and maximizing the value of already successful businesses.

Another good example in the realm of private equity would be Heinz, the food processing company. In 2013, Heinz was taken private in a deal orchestrated by Berkshire Hathaway and the PE firm 3G Capital. The PE firms aimed to streamline operations, reduce costs, and improve profitability. In 2015, Heinz merged with Kraft Foods, creating one of the largest food and beverage companies in the world.

This illustrates the PE model of investing in mature companies with steady cash flows and working to enhance their value.

Final Thoughts

Both private equity and venture capital offer unique opportunities for entrepreneurs and investors alike. Private equity provides established businesses with the necessary capital to expand and improve their operations, while venture capital fuels the growth of innovative startups with high growth potential.

Your choice between the two will largely depend on your risk tolerance, financial goals, and your specific business or investment strategy. As always, thorough due diligence and careful consideration of the dynamic environment in which these funds operate are fundamental in navigating the intricate landscapes of private equity and venture capital.